Loans - Anytime, Anywhere

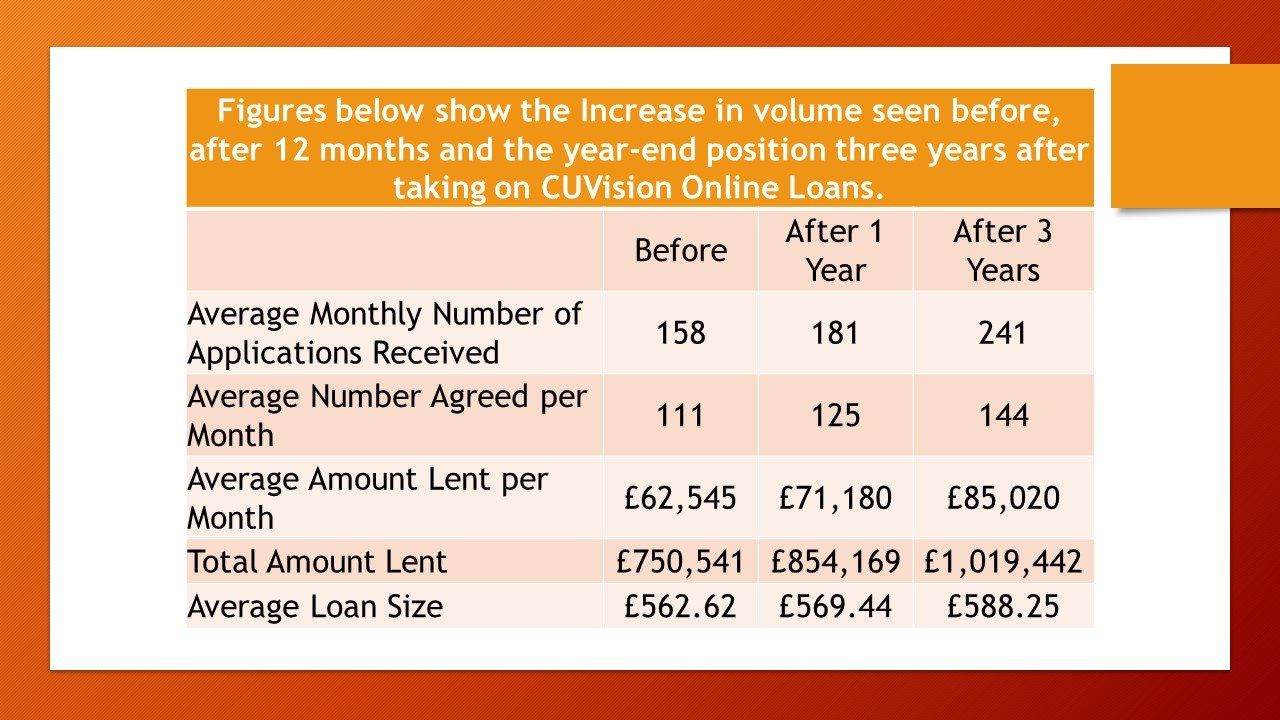

A 3 year journey delivers success for a credit union in the UK. Loans in the credit union had stagnated and had not grown for three years. Bringing in CUVision Online Loans has enabled steady annual growth and as the figures show the credit union lent over a million last year up from £750k three years ago.

A small team of six staff of which only two are full time yet processed 2,898 loans last year approving 1,733 of them. The credit union could not have coped with this volume prior to CUVision Online Loans.

The online loans module enables all loan documentation to be stored in one place.

This starts with the member’s application which is done from the comfort of their own homes at a time to suit themselves. It also means the credit union are open 24/7 and have a nice number of applications waiting for us on a Monday morning.

The applications are processed on CUVision Online Loans Worklfow and if agreed issue the agreement electronically to the members email and they accept this and send it back to us and then the loan is paid out. For those without access to a PC, Smartphone or Tablet, the credit union accept paper based applications and a staff members keys this onto CUVision Online Loans on behalf of the member. The credit union then print the agreement for the member to come back in and sign. The benefits to us mean we have one place where all documents are stored, application, Credit Check, Bank Statement, Loan Officer Decision & Agreement Form. This enabled us to archive 16 filing cabinets of paper.

Loan decisioning is much quicker too.

Many of our loans are turned around same day while small top up loans take less than five minutes to agree and issue the agreement. Having all the documentation in one place makes life easier for our Supervisory Committee too and our Accountants have access to CUVision Online Loans so that they can easily audit us without being a present in the office.

The one problem we found is that once you have the online presence you do get more poor quality applications as you are seen to be a new name in the marketplace. This does means that potentially your costs may increase due to the number of Credit Checks you carry out but this will vary depending on your risk appetite. This credit union is rather tight so their costs have increased however, the steady growth we have achieved would not have been possible without the introduction of CUVision Online Loans. The credit union were on target to achieve our 2019-20 target of £1,125,000 lending until the pandemic. The credit union will be around £40,000 short of that by end of April as we have seen a reduction in applications.

If you are looking to grow your loan book and don’t currently have an online presence the credit union would highly recommend introducing CUVision Online Loans. It has enabled us to move the business forward and become profitable. Members love it they no longer have to come in and queue for a form and it avoids those awkward situations whereby the member has had to make three visits to achieve a loan, once to apply, once to drop off statements and then finally to sign.